Sayona to Acquire a 9.99% Shareholding in Jourdan Resources

Highlights

- Earn-in agreement over Jourdan Resources’ Vallée lithium project allows Jourdan to further expand its exploration towards a potential resource and future mine.

- Sayona to acquire a 9.99% shareholding in Jourdan Resources for C$1.5 million.

- Sayona’s subsidiary, North American Lithium Inc., (“NAL”) has the right to earn up to a 51% stake in the Vallée lithium project, based on milestones.

- Agreement allows for ore on Vallée to be fast-tracked into the NAL plant for processing.

- Through earn-in and joint venture arrangement, Jourdan & Sayona will work in tandem to advance the Vallée lithium project as well as the region itself, including an extensive drill & exploration program for the Vallée lithium project.

- Jourdan intends on swiftly expanding exploration throughout its three projects, the Vallée lithium project, Baillarge lithium-moly, and Preissac – La Corne Lithium.

- Sayona to appoint nominee to Jourdan’s board of directors.

Toronto (Canada) – JOURDAN RESOURCES INC. (TSXV: JOR; OTCQB: JORF; FRA:2JR1) (“Jourdan”, “JourdanResources”, or the “Company“) is pleased to announce that it has signed an earn-in agreement and joint venture agreement (the “Agreement”) with Sayona Mining Limited’s (ASX: SYA; OTCQB: SYAXF) (“Sayona”) subsidiary, North American Lithium Inc., in relation to the Company’s Vallée lithium project. The Company is also pleased to announce that Sayona’s subsidiary, Sayona Québec Inc., has entered into an agreement with the Company to acquire 27,000,000 common shares of the Company (the “Common Shares”), representing approximately 9.9865% of the issued and outstanding Common Shares (on a post-closing basis), at a price of $0.0556 per Common Share for gross proceeds of $1,501,200 (the “Private Placement”). The Private Placement is expected to close within two (2) business days. Upon closing of the Private Placement, Sayona will have the right to nominate one director to the Company’s board of directors. All securities issued in connection with the Private Placement will be subject to a statutory hold period of four-months and one day. Completion of the Private Placement is subject to a number of conditions, including without limitation, receipt of TSX Venture Exchange approval. No finder’s fees will be paid in connection with the Private Placement. The Company intends to use the net proceeds of the Private Placement for working capital and general corporate purposes.

Rene Bharti, Jourdan’s chief executive officer, commented, “We are tremendously excited to begin what we feel will be a long-term partnership with Sayona. Given the incredible progress they have made at the NAL mine, we anticipate that this partnership will allow Jourdan to advance the exploration and development of its Vallée lithium project toward production without having to incur many of the associated costs. Indeed, we understand that Sayona has complete infrastructure in place to begin lithium production from its NAL properties in Q1 of next year. We are very proud to be working with our neighbours, and we look forward to welcoming a top Sayona executive to the Jourdan board in order to further cement our partnership.”

“We are excited to start a new chapter in the lifecycle of Jourdan Resources by joining forces with Sayona and neighbouring NAL”, says Dr. Andy Rompel, Exec. Chairman. “We believe that this partnership will be tremendously beneficial mutually as we anticipate that both parties can contribute significantly to the advance of exploration and potential resource estimation on our flagship project, Vallée. We expect that this partnership will increase the speed of exploration for Jourdan, as well as give us the unique ability to process our ore through the NAL plant.”

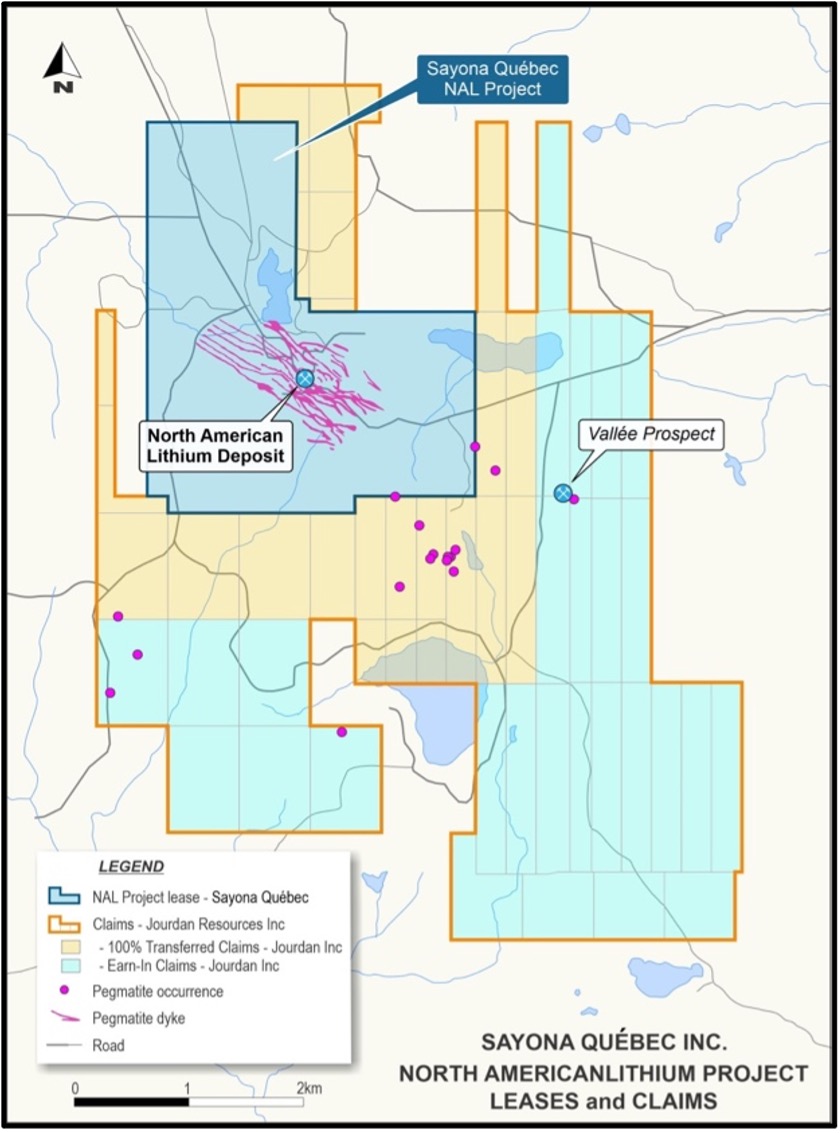

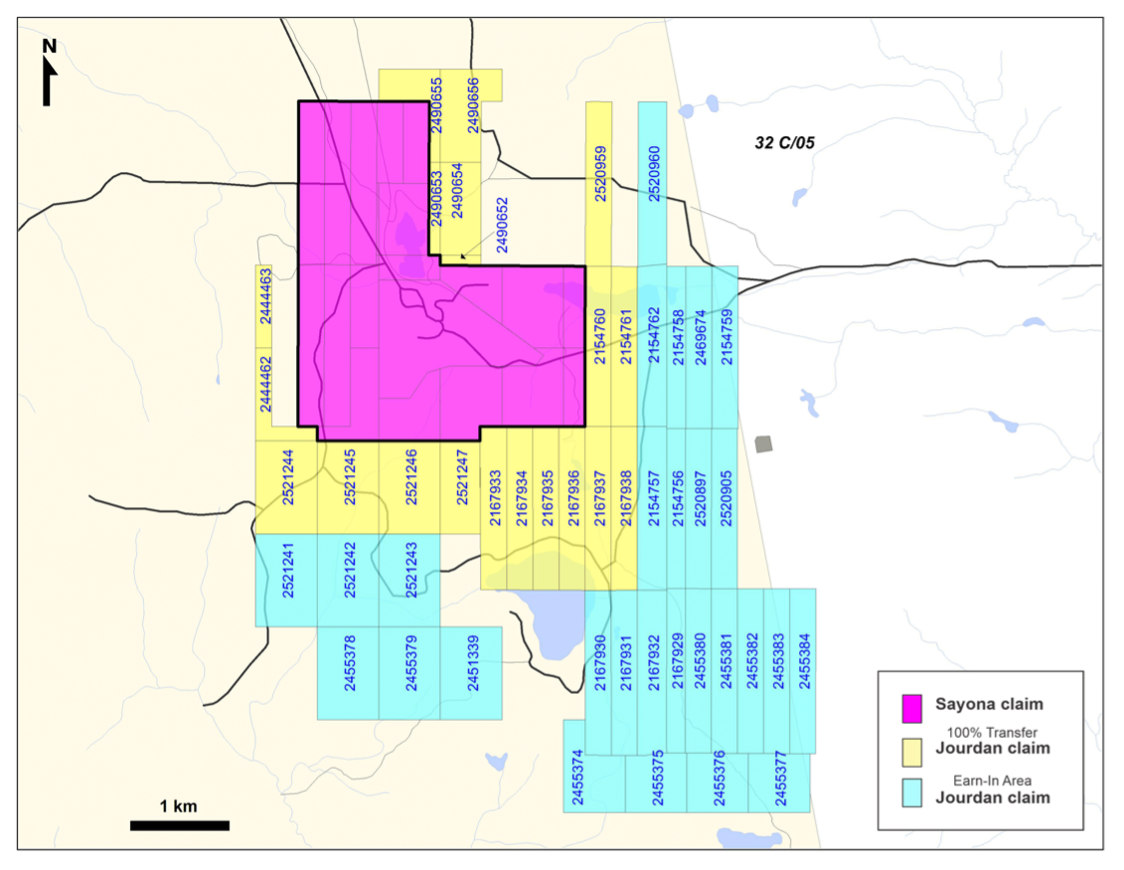

Under the Agreement, NAL has the right to earn up to a 51% stake in 28 claims within the Vallée project, which includes pegmatite targets located close to and along strike from NAL’s orebody. This is based on NAL spending C$4 million within the first year to earn a 25% interest and an additional C$6M within two years to earn a further 25% interest. NAL also has the right to increase its interest by an additional 1%, to an aggregate 51% interest, by completing a feasibility study and arranging funding for the construction of a mine at Vallée.

In connection with the Agreement, Jourdan has transferred 20 claims outright to Sayona to provide for potential future infrastructure expansion at the NAL mine and its processing facility.

Sayona’s Managing Director, Brett Lynch, stated that the Agreement provided a substantial boost for NAL and its future production potential. “Sayona continues to review opportunities for expansion and this earn-in agreement is an excellent opportunity to swiftly expand NAL’s potential resource base, paving the way for an increase in NAL’s future mine production capacity,” he said.

He continued, “With mineralised spodumene pegmatite dykes previously mined by NAL continuing directly onto Jourdan’s claims, we are keen to quickly launch new drilling. Significantly, the additional leases acquired under this agreement will also allow for increased flexibility and optimisation of the NAL mine design, production and infrastructure.”

DLA Piper (Canada) LLP acted as legal counsel to Jourdan. Desjardins Capital Markets acted as exclusive financial adviser and McCarthy Tétrault LLP acted as legal counsel to Sayona for the transaction.

Vallée Lithium Project

The Vallée lithium project comprises 48 claims covering 1,997 ha, closely neighbouring the NAL mine tenure with 20 of the leases located within 500m of the mine tenure boundary. Known pegmatites have been recorded in past exploration and are orientated along strike from the NAL orebody. Critically, the tenure secures the prospective granodiorite host and its contact zone, which are important ore controls in the NAL deposit.

More broadly within the Jourdan claims, some 14 pegmatite occurrences are recorded in government data, indicating the high exploration upside for discovery of mineralisation for blending into the NAL operation.

Exploration work, including geochemistry, geophysics and an aggressive drilling program, is being planned by Sayona. Sayona’s exploration team has already confirmed multiple high potential target areas for drill testing.

Figure 1: View of NAL mine area and Jourdan’s Vallée claims

Figure 2: Vallée Project – outcropping pegmatite

Figure 3: Sayona’s Jourdan claims

Figure 4: Jourdan Chairman Dr. Andy Rompel & Sayona VP Exploration Carl Corriveau at site in Quebec

The Vallée project is located in Abitibi, Québec, near the township of La Corne. The project is situated within the heart of the southern portion of the Abitibi Greenstone Belt, some 100 kilometres northeast of the mining towns of Rouyn-Noranda, 45 kilometres north of Val-d’Or, 50 kilometres northeast of Malartic (home to the Canadian-Malartic Mine), 30 kilometres southeast of Amos and contiguous and in proximity to RB Energy’s Quebec Lithium Property and adjacent to the NAL mine. The mineralised spodumene pegmatite dykes that NAL has mined continue directly onto the claims of Jourdan.

The Vallée lithium project’s claim block is geologically located on the northeast edge of the Preissac‐Lacorne batholite and east of the edge of the late pluto of La Corne. The intrusive rocks of the dioritic to early granodioritic suite largely make up its geology targeted by drilling. However, the upper part of the block contains volcanic rocks of felsic to mafic composition of the Aurora Group.

Qualified Person

The scientific and technical information contained herein has been reviewed and approved by Alexandr Beloborodov, P.Geo., an independent consultant who is a “qualified person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

For more information:

Rene Bharti, Chief Executive Officer and President

Email: info@jourdaninc.com

Phone: (416) 861-5800

www.consolidatedlithium.com

About Sayona Mining

Sayona Mining Limited is an emerging lithium producer (ASX:SYA; OTCQB:SYAXF), with projects in Québec, Canada and Western Australia.

In Québec, Sayona’s assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (Nasdaq:PLL; ASX:PLL). The Company also holds a 60% stake in the Moblan Lithium Project in northern Québec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects are subject to an earn-in agreement with Morella Corporation (ASX:1MC).

For more information, please visit us at www.sayonamining.com.au

About Jourdan Resources Inc.

Jourdan Resources Inc. is a Canadian junior mining exploration company trading under the symbol “JOR” on the TSX Venture Exchange and “2JR1” on the Stuttgart Stock Exchange. The Company is focused on the acquisition, exploration, production, and development of mining properties. The Company’s properties are in Quebec, Canada, primarily in the spodumene-bearing pegmatites of the La Corne Batholith, around North American Lithium’s producing Quebec Lithium Mine.

Cautionary statements

The Company cautions that it is not basing any production decisions on a feasibility study of mineral reserves demonstrating economic and technical viability at the Vallée lithium project, and as a result there is increased uncertainty and there are multiple technical and economic risks of failure which are associated with any such production decision. These risks, among others, include areas that are analysed in more detail in a feasibility study, such as applying economic analysis to resources and reserves and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.

This press release contains “forward‑looking information” within the meaning of applicable Canadian securities legislation. Forward‑looking information includes, but is not limited to, statements with respect to the Agreement, the Private Placement and the closing thereof, the advancement of the exploration and development of the Vallée lithium project toward production, and the ability of the Company to establish a preliminary mineral resource estimate at its properties, become a lithium producer, and to execute its business plan. Generally, forward‑looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward‑looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Jourdan to be materially different from those expressed or implied by such forward‑looking information, including but not limited to: risks that the transactions contemplated in Agreement will not be completed as anticipated, or at all; risks that the Private Placement will not be completed as anticipated, or at all; risks that the Company will not be able to advance the exploration and development of the Vallée lithium project toward production as contemplated, or at all; receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future mineral prices and market demand; accidents, labour disputes and shortages and other risks of the mining industry. Although Jourdan has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward‑looking information. Jourdan does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.